MANAGE YOUR WEALTH

LIKE YOU MEAN BUSINESS.

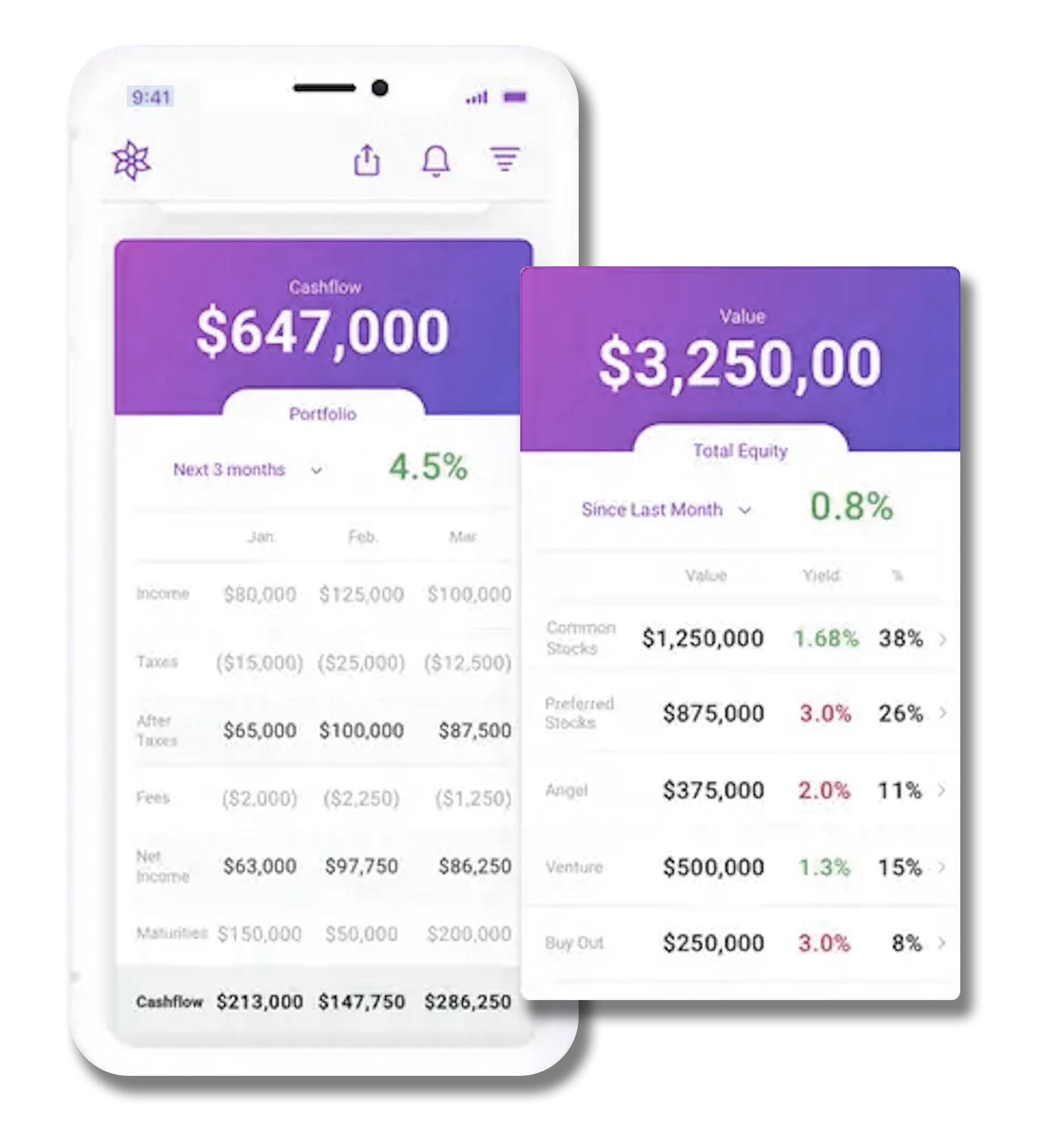

HOLISTIC VIEW OF WEALTH

|

ALTERNATIVE INVESTMENTS

|

INCOME AND EXPENSE

|

|

From banking, brokerage, and alternative assets, to crypto, residences, personal property, and collectibles; Annise is able to capture it all.

Add angel, private equity, real estate, venture fund, and others, along with private lines of credit and mortgages; manage capital calls, quarterly statements, projected income, and K-1s –all in Annise.

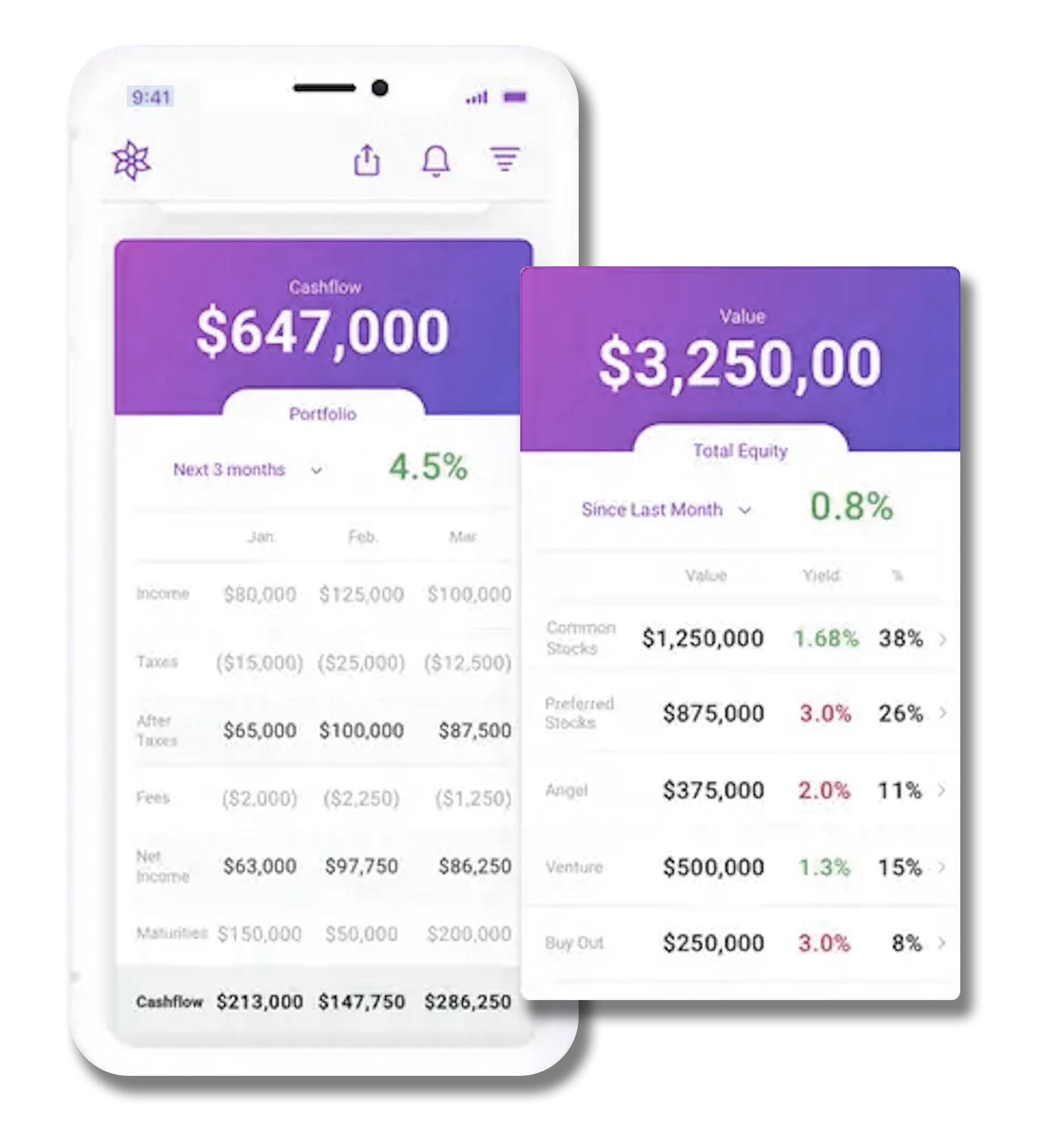

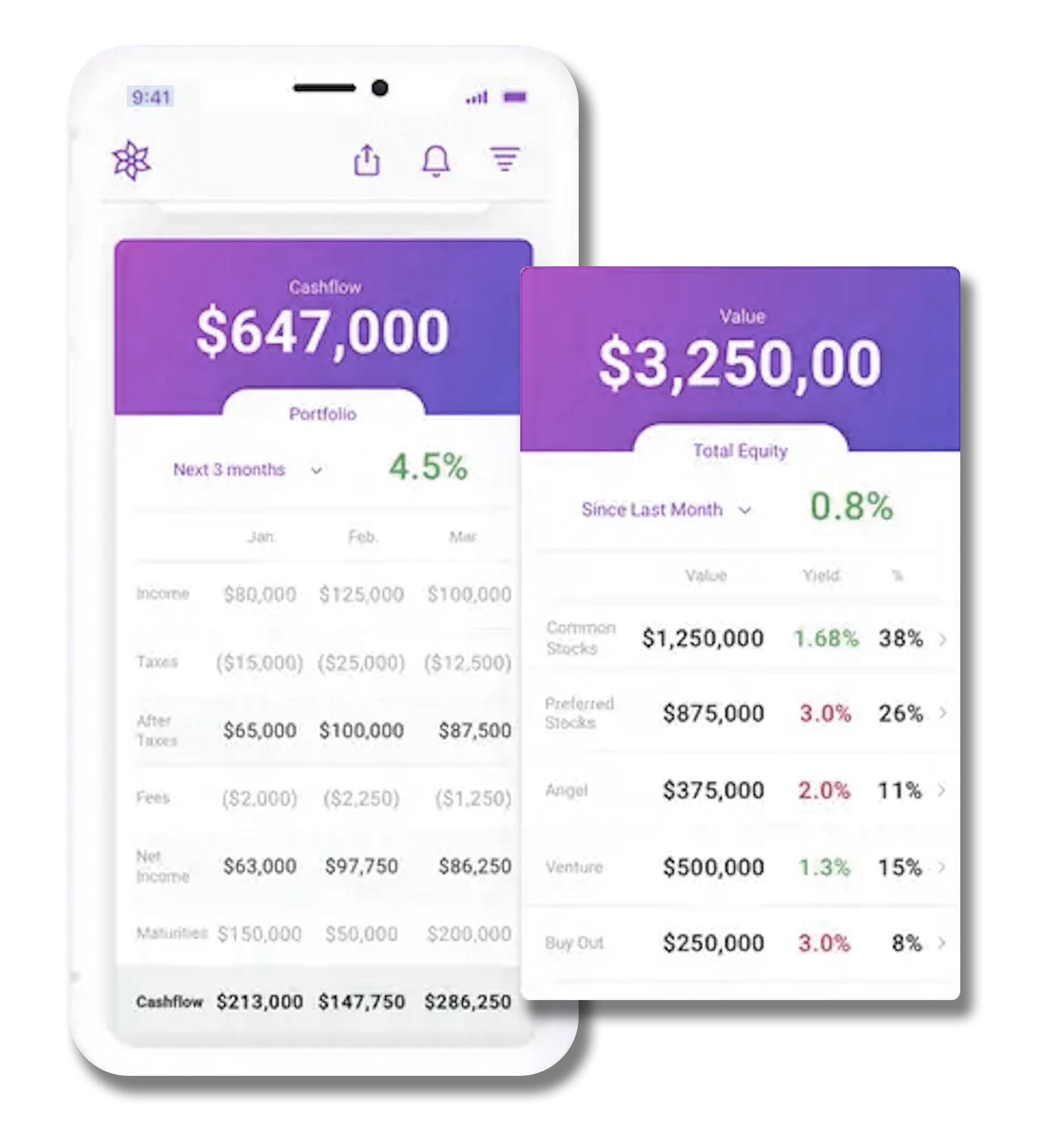

Annise delivers insights, opportunities, and benchmarks; calculates MOICs and IRRs; provides robust performance reporting on your investments; and offers cash flow insights and tax forecasts, helping you stay ahead of your cash needs.

Annise supports estate and trust management, enables the assignment of assets to specific trusts as well as trustees and beneficiaries, and provides relevant party access and document management.

Annise provides transparency and control - from transactions and fees to investment performance. If you change financial institutions or advisors, your data will stay with you.

Trusts

Whether you have revocable, irrevocable, Crummey, DAF, or any other trust, you'll want to understand assets, performance, and estimated income - and manage accordingly. Add donors, trustees, beneficiaries, and estate attorneys as members, giving them view/edit rights to ensure transparency and ease-of access to the latest data. Assign accounts, assets and liabilities to various irrevocable and revocable trusts to ensure retitling, and add/permission trustees, beneficiaries, executors, and trust advisors to view each trust.

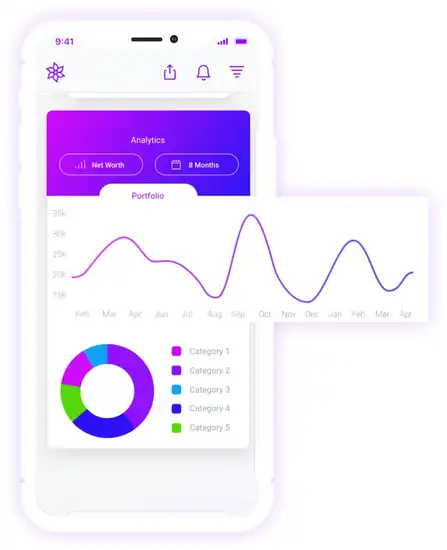

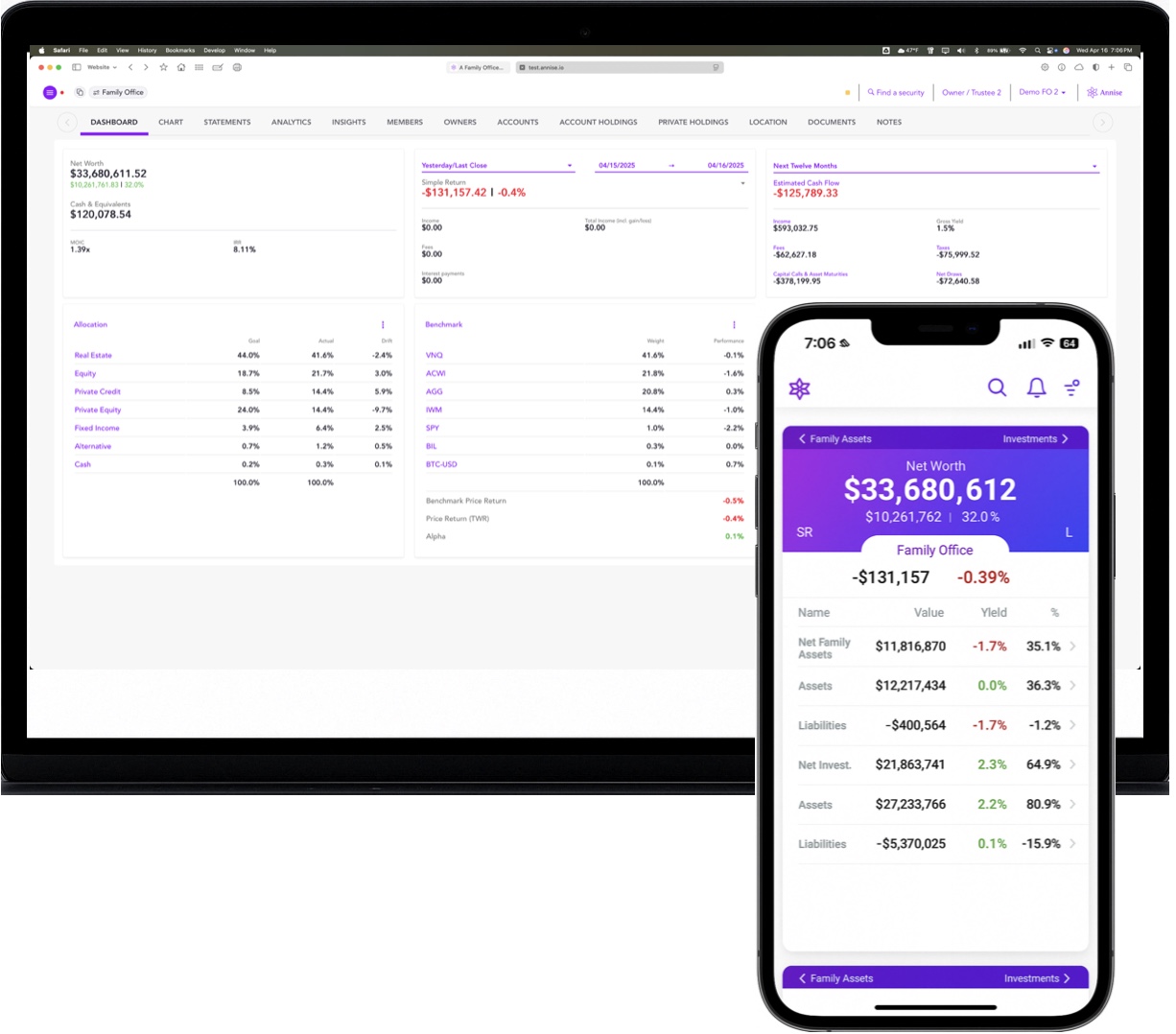

Analytics

Spend, Allocations, Performance against benchmarks, J-Curve, DAF giving and many other analytics that are account, asset, trust, and family office specific, provide insights and opportunities across your portfolio.

Annise is continually assessing the totality of your banking, brokerage, and alternative assets to alert you of insights and opportunities to consider / discuss with your advisor team. Whether it's analyzing allocation goals and drift for rebalancing, or expected capital calls vs cash and credit available, Annise will keep you informed of potential opportunities.

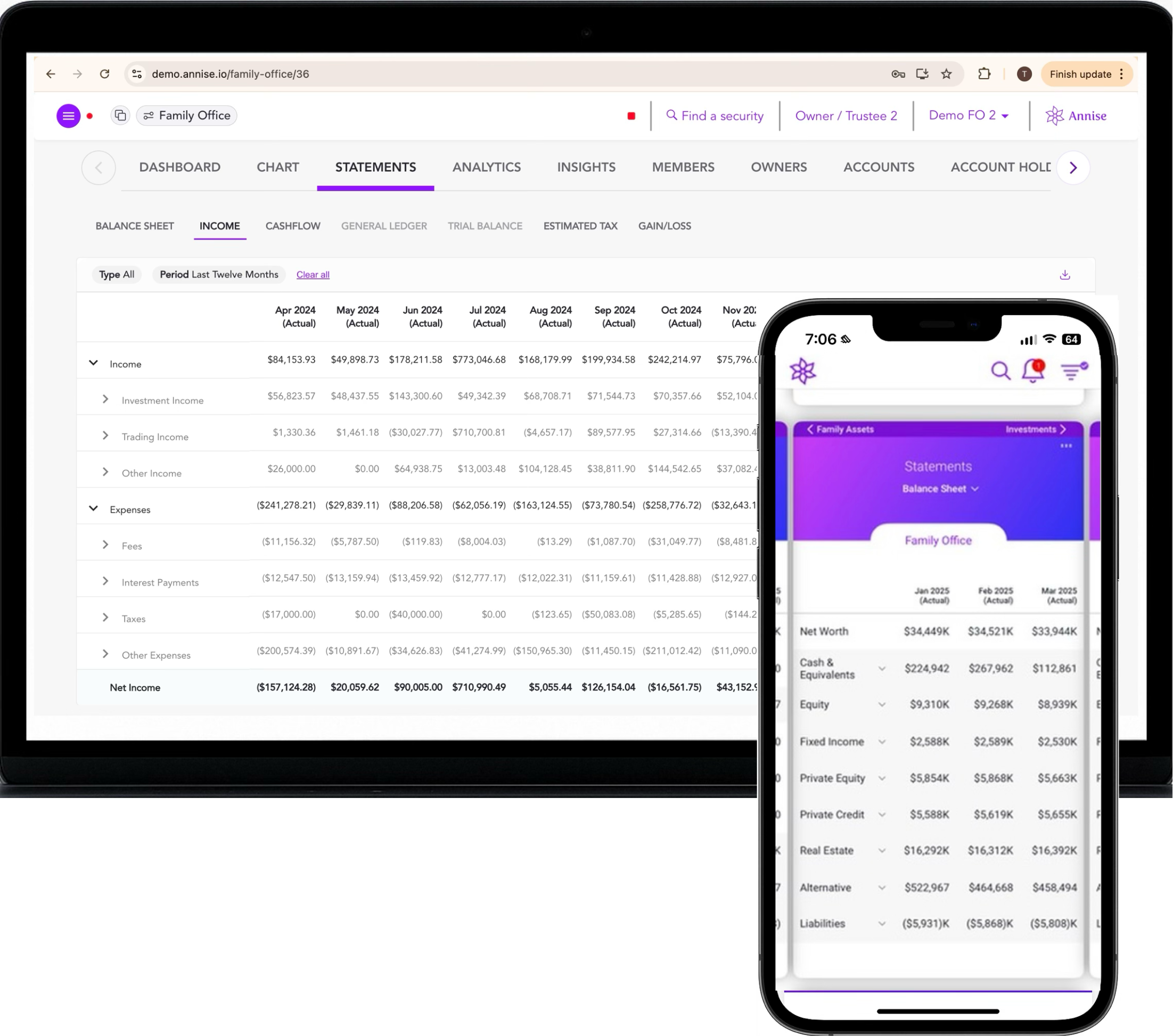

Statements

Analyzing financial statements by way of a full cash-based general ledger is a must as your net worth grows. Typical balance sheet, income statement and cash flow statements are further enhanced with trial balance and general ledger statements augmented by quarterly estimated tax statements and gain / loss statements to provide a truly holistic view of your family office.

Balance sheet, income statement, cash flow, estimated taxes, and capital gains/loss statements are available at the family office, trust, account, and individual asset levels - down to the tax lot level. Customize assets into preferred asset and sub-asset classes, add associated data elements like cost, ownership, and annual income, and save into reports you can revisit and share with members.

Alternative Assets

Add your angel, real estate, company options, venture fund investments, and other alternative assets, along with associated lines of credit and mortgages, and manage your net investments. MOICs and IRRs are calculated at the asset and asset class level.

Managing capital calls, quarterly statements, projected income, liquidity, and K-1s is easy and intuitive.

Upload, drag and drop, email, or have Annise download and process your limited partner documents for no additional charge. Annise will process quarterly statements, capital calls, etc. for you so your family office is always reconciled and up to date.

Brokerage

Connect and sync your 401(k), IRA, HSA, 529, and other brokerage accounts and manage your custodial investments with Annise. Also, connect and sync Coinbase to incorporate your crypto assets.

Keep track of industry and geographic exposure, results relative to benchmark, projected portfolio income, bond maturities, and liquidity management.

Upload, drag and drop, email, or have Annise download and process your monthly custodial statements at no additional cost, ensuring your family office is always reconciled and up to date.

Banking

Connect and sync your checking, savings, credit cards, lines of credit, mortgages and other bank accounts. Transactions come in automatically, are stored in the cloud, and can be categorized as income or expenses. Personalize categories however you like, and these will show up in statements and analytics.

Bank accounts seamlessly integrate with your brokerage accounts, alternative investments and trusts providing a one-stop-shop for expense management and a holistic, performance-focused view of your wealth.

An AI-enabled unified wealth and expense management solution

Annise is an AI-enabled unified wealth and expense management solution — a Unified Wealth Operating System (UWOS) for investors, families, and their advisors – integrating banking / income and expense, brokerage (including crypto), alternative assets, personal property, and accounting into a single, next-gen wealth management system. Annise provides the same powerful tools used by professional family offices without the complexity or high costs. It’s where individuals and families graduate to when Quicken, Excel, and fragmented tools no longer suffice. Annise enables a family office approach to managing wealth without the overhead of legacy software and expensive family office infrastructure.

Save Time,

Gain Clarity,

Take Control.

-

Everything in one place

-

Get rid of spreadsheets

-

Add and track alternatives with AI-enabled document management

-

Understand performance, calculate MOICs, IRRs

-

Control your data

Where are you in your wealth journey?

What people are saying about Annise.

“This is the most impressive FO software I’ve ever seen and I’ve seen a lot.”

Investor

“It’s really great you have all the estate plans, trusts, etc. I especially like you can invite your executor. Today, I have a binder and it’s awful and I have to keep it up to date.”

Investor

“It’s incredible. I’ve not seen anything that’s this comprehensive at your price point. I think a lot of new advisors would use this immediately.”

Advisor

My advisor will finally be able to see all of my assets”

Investor

“I keep everything on a million spreadsheets today. One for my wife, one for my kids .. I can’t keep track of capital calls. This would help a lot.”

Investor

“Great you can separate RIA permissions to manage different assets, I’ve got one managing a muni ladder and another corporates. This would be perfect.”

Investor

Become a partner

Annise is a comprehensive wealth management platform on which Advisors empower their clients and build their businesses.

Financial advisors see across asset classes and managers. Tax Advisors can see projected taxable income and scenario plans around the exercise of options for the sale of a company. Estate Advisors can see exactly how well clients are doing re-titling assets to different revocable and irrevocable trusts. All advisors are working with the same data.

In other words, Annise is a one-stop platform for all Advisors to have a consolidated and enriched view to make the best recommendations possible.

Our True North

Your data is yours. Always. Annise is built with privacy and protection at its core, and designed with a “you own your own data” philosophy. We never sell, share or monetize your information. Your financial data stays private and under your control — and you decide who has access, and to which accounts and holdings.

Our Partners

-Logo_wine.png)

Our Partners

-Logo_wine.png)

-Logo_wine.png)

Our Partners

The support you need,

when you need it.

Onboarding, uploading history, and account reconciliation can be done by you or by your Annise team.

Once you sign up for a trial, your support team will be available to help as needed with initial set-up, including syncing of accounts, entering alternative assets, establishing trusts, and inviting members.

Once established, your Annise team can also help with uploading historical data and reconciling accounts.

You decide how much you'd like us to help.

FAQs

Frequently Asked Questions

What is Annise?

Annise is an AI-powered Unified Wealth Operating System (UWOS) that brings together your banking, brokerage (including crypto), alternative investments, personal assets, trusts, and accounting into one intelligent platform — delivering family-office-level capabilities and insight without the cost or complexity.

Who is Annise for?

Annise is built for investors,, families, and their advisors managing growing or complex wealth. It’s ideal for anyone outgrowing tools like Quicken or spreadsheets and needing a holistic view across public and private assets.

How much does Annise cost?

Annise uses simple, feature-based pricing. Start with unlimited syncing of banking, brokerage, real estate, and alternative assets. Upgrade for advanced features like trusts, deeper analytics, and AI automation. Each tier offers unlimited usage of features (e.g no per member, document ingestion, or other "per usage" charges.)

You can try everything free for 90 days — no credit card required.Does Annise offer a free trial?

Yes. Every account includes a full 90-day free trial with access to all features. At the end, choose a plan that fits your needs or cancel anytime.

How does Annise handle security and privacy?

Your data is always yours — portable, private, and never sold. Annise protects your data with encryption at rest and in transit, two-factor authentication, secure data aggregators (such as Plaid), and strict permissioning and granular permission controls so only authorized people can view specific accounts or assets.

Which accounts and assets can I connect?

You can connect and sync:

-

Banking and credit cards

-

Brokerage accounts (401(k), IRA, HSA, taxable)

-

Crypto accounts (e.g., Coinbase)

-

Real estate and private investments

-

Private equity, venture, and alternative assets

-

Personal property, mortgages, and trusts

Both automated and manual tracking are supported.

-

How do advisors or family members access my data?

You control access at a granular level — granting view or edit permissions by asset, account, trust, or entity. Invite advisors, trustees, beneficiaries, or family members with precisely defined visibility.

Does Annise work on mobile devices?

Yes. Annise works best on the web for deep analysis and financial management, with quick-access and insights available via iOS, widgets, Apple Watch.

Can Annise help with setup or historical data?

Yes. Annise offers onboarding and basic setup assistance. For more complex historical data, reconciliations, or document ingestion, white-glove support is available as an optional service.

Does Annise offer financial advice?

No. Annise is a technology platform for organizing, understanding and managing your wealth. It does not provide investment, tax, or legal advice.

What makes Annise different from other wealth tools?

Annise is built around how real families manage wealth — across entities, trusts, and generations — not just accounts. It’s designed to replace spreadsheets, reduce fragmentation, and create a single source of truth for complex financial lives. Annise provides:

-

Holistic view of wealth

-

CFO dashboard including balance sheet, income statement and cash flow

-

Real time (updated every 20 min) financial data

-

AI enabled agents

-

Ability to group assets by trust, manager and advisor

-

24/7/365 working for you

-

Why investors love Annise.

"You can tell it was designed by someone who's using it. You can definitely tell it was built for the investor."

"My advisor will finally be able to see all of my assets."

“It’s really great you have all the estate plans, trusts, etc. I especially like you can invite your executor. Today, I have a binder and it’s awful and

I have to keep it up to date.”